Our therapeutics address serious unmet medical needs to combat the growing threat of infectious diseases, from antivirals for high-risk patient populations to antibiotics for multi-drug resistant pathogens.

Antivirals for High-Risk Patient Populations

Adenovirus & hCMV Treatment for Immunocompromised Patients

Overview: Adenoviruses are ubiquitous in human and animal populations and are able to survive outside a host for long periods of time. Transmission occurs by touching the eyes, through aerosolized droplets, or by exposure to infected tissue or blood. Due to their diversity, adenoviruses are a causative agent for many syndromes, including: acute respiratory disease, pharyngoconjunctival fever, epidemic keratoconjunctivitis, acute hemorrhagic cyctitis, gastroenteritis, and viremia as associated with disseminated infection. Typically self-limiting in healthy populations, adenovirus infection is life-threatening in immunosuppressed and immunocompromised patients, including hematopoietic stem cell transplantation (HSCT) recipients, solid organ transplant (SOT) patients, and HIV-infected individuals. Mortality rates can be especially significant in pediatric transplant patients, often exceeding 50% [1]. Studies have shown that 30% of “high-risk” patients develop multiple viral infections, including cytomegalovirus (hCMV) and herpes viruses’ infections like Epstein–Barr (EBV), illustrating the need for a broad-spectrum antiviral agent [2].

Potential Regulatory Benefits: Orphan Drug Designation, Pediatric Exclusivity, Fast-Track, Accelerated Review.

Market: The total global market for an effective, hAdV therapeutic is very difficult to estimate to due lack of available data. As a result, we compare payer prices for reimbursed procedures relative to corresponding healthcare savings in the United States. Using the fraction of HSCT and SOT recipients in the US as a proxy (29%) of the global total, we estimate the total market for an effective HAdV therapeutic to be about $420 million per year. This market is growing due to many factors, including: growth of donor databases, improvements in donor transplantation, and increasing numbers of allogeneic transplants.

Influenza Treatment for Hospitalized Patients

Overview: Influenza (“the flu”) is an infectious disease caused by RNA viruses that affects birds and mammals. Human influenza A and B viruses cause two seasonal epidemics of disease per year—one per hemisphere—resulting in three to five million severe cases and around 500,000 deaths globally [3]. Although the incidence of flu can vary widely by season, approximately 36,000 deaths and more than 200,000 hospitalizations are directly associated with the flu every year in the United States alone [4]. Current options to prevent and treat the flu include vaccines and antiviral drugs, respectively, and each has its limitations. First, vaccines are only effective against certain strains of the virus with seasonal efficacy ranging between 10% and 60% [5]. Second, vaccines can only be used prophylactically and large portions of the population opt not to get vaccinated. Third, there are cost and accessibility/availability issues, as stocks expire at the end of each season and need to be replenished. A combination of these factors result in poor vaccination coverage, typically less than 50% of the overall population for any given year and even less (<20%) during pandemics. Antiviral drugs, including neuraminidase inhibitors like oseltamivir, are also seeing emerging resistance in seasonal and pandemic flu.

Potential Regulatory Benefits: Orphan Drug Designation, Fast-Track, Accelerated Review.

Market: The total global market for influenza antivirals—which does not include vaccines—exceeded $1.5 billion USD in 2014, based on worldwide sales of the top two selling drugs Tamiflu® (oseltamivir) and Relenza® (zanamivir). Sales in the United States totaled $800 million in 2014 and grew, on average, more than 25% every year since 2010. Pandemics, seasonal variations, and government stockpiling efforts all affect annual influenza therapeutics sales and make forecasting difficult. We believe, however, a novel influenza therapeutic with a higher potency and superior antiviral resistance profile represents over $300 million/year in sales revenue, driven by government stockpiling.

Antibiotics for Drug-Resistant Bacterial Infections

Methicillin- and Vancomycin-Resistant Staphylococcus Aureus (MRSA/VRSA)

Overview: MRSA and VRSA are strains of Staphylococcus aureus, a gram-positive bacterium that causes hundreds of thousands of infections per year in the United States. These clinically significant strains of Staphylococcus have developed resistance to beta-lactam antibiotics like penicillins and cephalosporins. Some strains have emerging resistance to newer antibiotics like linezolid, daptomycin, and tigecycline. For MRSA, the first line of treatment is the glycopeptide antibiotic vancomycin, which can be expensive and time consuming to administer. Moreover, many clinicians believe that the efficacy of vancomycin against MRSA is inferior to that of anti-staphylococcal beta-lactam antibiotics against methicillin-susceptible Staphylococcus aureus. Several newly discovered strains of VRSA show antibiotic resistance to vancomycin and teicoplanin.

Currently, fifth generation cephalosporins are used in the treatment of MRSA but they hold much smaller market share compared to generics like vanvomycin and teicoplanin (latter approved in EU). Coagulase-negative staphylococci have flourished in nosocomial environments where broad-spectrum cephalosporins have been used and glycopeptide-resistant enterococci and S. aureus have also emerged. To combat this emerging resistance, the United States, under the Generating Antibiotics Incentives Now Act (GAIN Act), has developed a shortened regulatory and review process for Qualified Infectious Disease Products (QIDPs) for antibiotics and antifungals.

Potential Regulatory Benefits: Qualified Infectious Disease Product Exclusivity, Fast-Track, Accelerated Review.

Market: The global MRSA therapeutics market stood at $1.45 billion in 2006, which then grew at a compound annual growth rate (CAGR) of 12.9% to reach $2.7 billion in 2011. The market is expected to grow at a CAGR of 3.4% over the next eight years to reach $3.5 billion by 2019. A first in class, extended spectrum antibiotic would provide another route to combat emerging resistance across a wide range of severe gram-positive infections and potentially peak at $450 million per year in global sales [6].

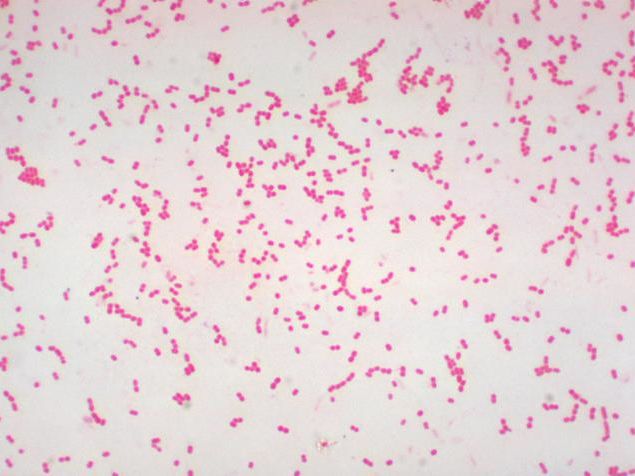

Pseudomonas Aeruginosa, Neisseria gonorrhoeae and Complicated Urinary Tract Infections

Overview: The emergence of multi-drug-resistant (i.e. cephalosporin-resistant) gram-negative bacterial infections like N. gonorrhoeae, E. coli, and P. aeruginosa have created a substantial need for the development of new therapies. As of 2010, ceftriaxone appears to be one of the few effective antibiotics left for treating multi-drug resistant infections with IV the only approved route of administration. Likewise, N. gonorrhoeae causes gonorrhea, the second most commonly reported sexually transmitted disease and a differential diagnosis to urinary tract infections. According to the CDC, an estimated 820,000 cases of the disease are contracted each year in the United States, of which 30% are resistant to existing antibiotics [7]. The disease can cause severe reproductive complications, including discharge and inflammation at the urethra, cervix, pharynx or rectum. Finally, P. aeruginosa causes significant nosocomial infections such as ventilator-associated pneumonia and various sepsis syndromes.

Potential Regulatory Benefits: Qualified Infectious Disease Product Exclusivity, Fast-Track, Accelerated Review.

Market: Treatment for gram negative infections is dominated by generic/branded 3rd generation cephalosporins like ceftriaxone, with newer approved 5th generation ceftolozane recently taking market share. Using sales estimates for these recent approvals as an analogue, the global market for an effective antibiotic for gram negative indications is expected to be $740 million per year. First in class antibacterials that can be administered in a single dose, that are safe and effective against drug-resistant gram-negative strains--including strains that are resistant to cephalosporins--with an oral step-down therapy would fit this criteria.